Calculate my income

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. First divide the weekly pay by 2.

Gross Income Formula Step By Step Calculations

Gross income per month 10 x 1040 12.

. QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. So benefit estimates made by the Quick Calculator are rough. Write down the net expected income for coverage year or download and save the PDF.

Gross income from salary Basic. Use this calculator to quickly estimate how much tax you will need to pay on your income. If youve already paid more than what you will owe in taxes youll likely receive a refund.

Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Ad Automate reports gain business insights manage receipts expenses. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. Everyone works with a different amount of income during their retirement. The Federal or IRS Taxes Are Listed.

Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Use the number of pay periods in. Chapter 62F statute requires distribution of the credits in proportion to personal income tax liability in Massachusetts incurred by taxpayers in the immediately preceding taxable year.

To convert to annual income. And is based on the tax brackets of 2021 and. 1200 2 600.

When filling out your application youll be shown the expected yearly income. Factors to Help Calculate a Good Retirement Income for You. The latest budget information from April 2022 is used to.

Next take the result from step 1 and move the decimal point two. To stop the auto-calculation you will need to delete. We would like to tell you that it is very easy to calculate income tax.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Iowa Income Tax Calculator 2021. The PAYE Calculator will auto calculate your saved Main gross salary.

See your tax refund estimate. The formula for calculating income tax on salary is as follows. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

As your total income goes up youll pay federal income tax on a portion of the benefits while the rest of your Social Security benefits remain tax-free. Your average tax rate is 1087 and your marginal tax rate is 22. How Your Paycheck Works.

If the amount shown is. QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. All other pay frequency inputs are assumed to be holidays and vacation.

You can change the calculation by saving a new Main income. The Connecticut Tax Calculator Lets You Calculate Your State Taxes For the Tax Year. Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

Gross income per month 10400 12. This calculator is always up to date and conforms to official Australian Tax Office rates and. The total you end up working with.

As many individuals do check your most current pay stub if you dont already know your annual wage. You can easily convert your hourly daily weekly or monthly income to an annual figure by using some simple formulas shown below. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

Using the steps in the shortcut method to calculate your annual pay. Gross income per month 86670. 15 Tax Calculators 15 Tax Calculators.

If you are early in your career or expect your income level to be higher in the future this kind of account could save you on taxes in the long run. Well calculate the difference on what you owe and what youve paid. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

That means that your net pay will be 43041 per year or 3587 per month. It is mainly intended for residents of the US. Gross income per month 10 x 20 x 52 12.

Simplify bookkeeping with Neats mobile accounting software storage. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Determine your annual income.

Although the Quick Calculator makes an initial assumption about your past earnings you will have the opportunity. If you make 63000 a year living in the region of Iowa USA you will be taxed 12039.

How To Calculate Net Income Formula And Examples Bench Accounting

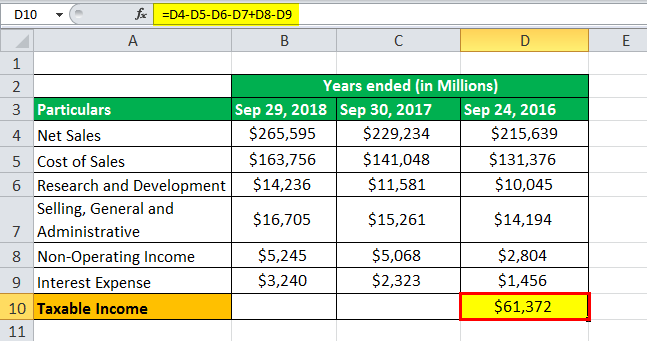

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Salary Formula Calculate Salary Calculator Excel Template

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

Annual Income Calculator

How To Calculate Net Pay Step By Step Example

Income Percentile Calculator For The United States

Gross Income Formula Step By Step Calculations

Net Worth Calculator Find Your Net Worth Nerdwallet

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Gross Income Per Month

4 Ways To Calculate Annual Salary Wikihow

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Income Tax In Excel